Ideal Tips About How To Reduce Property Tax Bill

History of senior property tax exemption (2022) the senior homestead property tax exemption became available beginning in property tax year 2002, following voter approval of referendum.

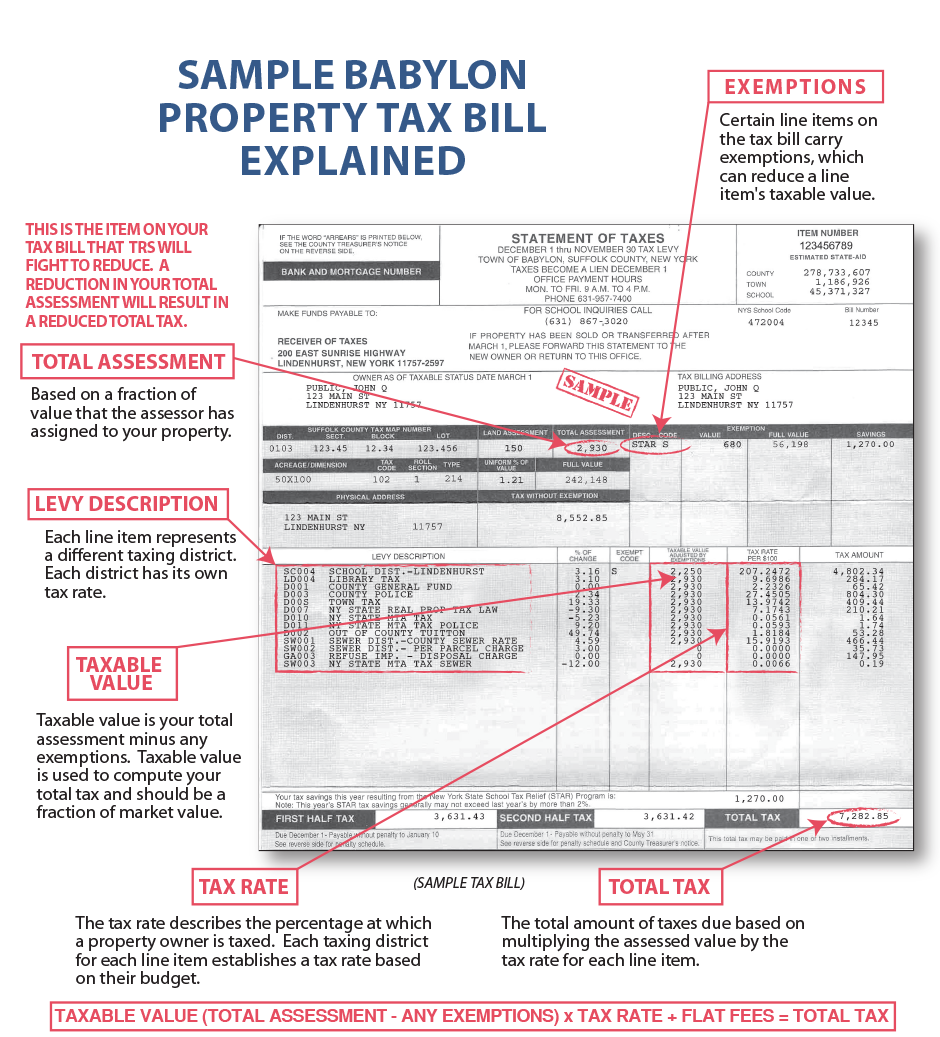

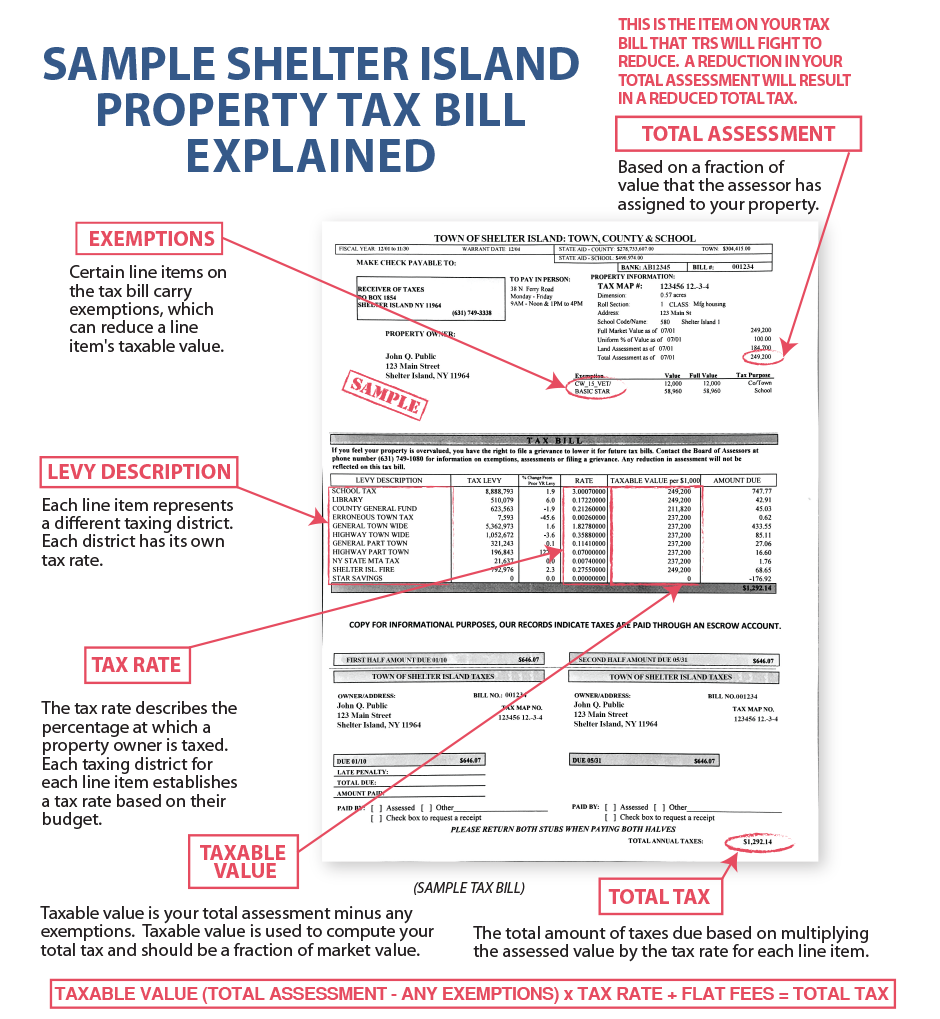

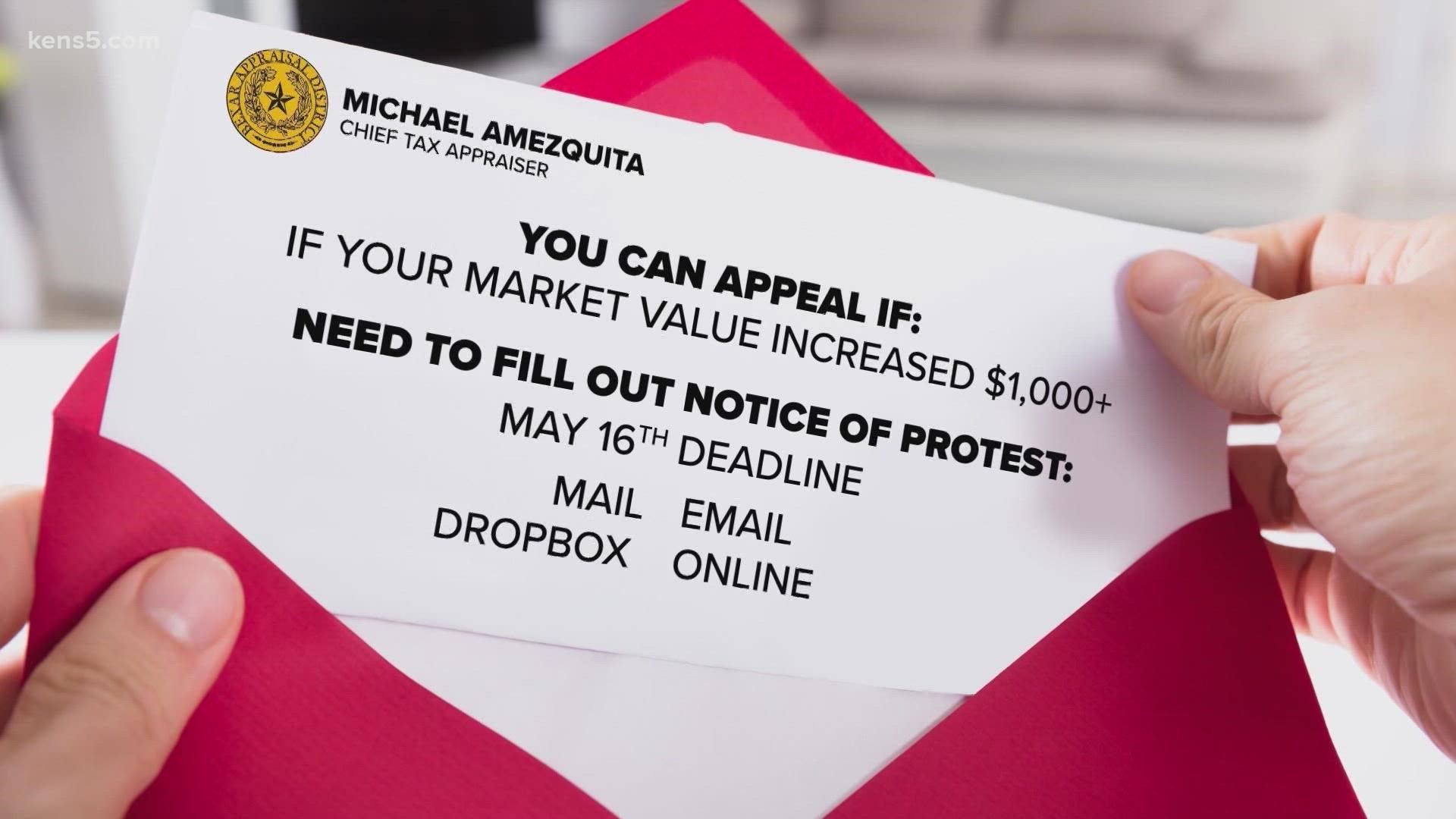

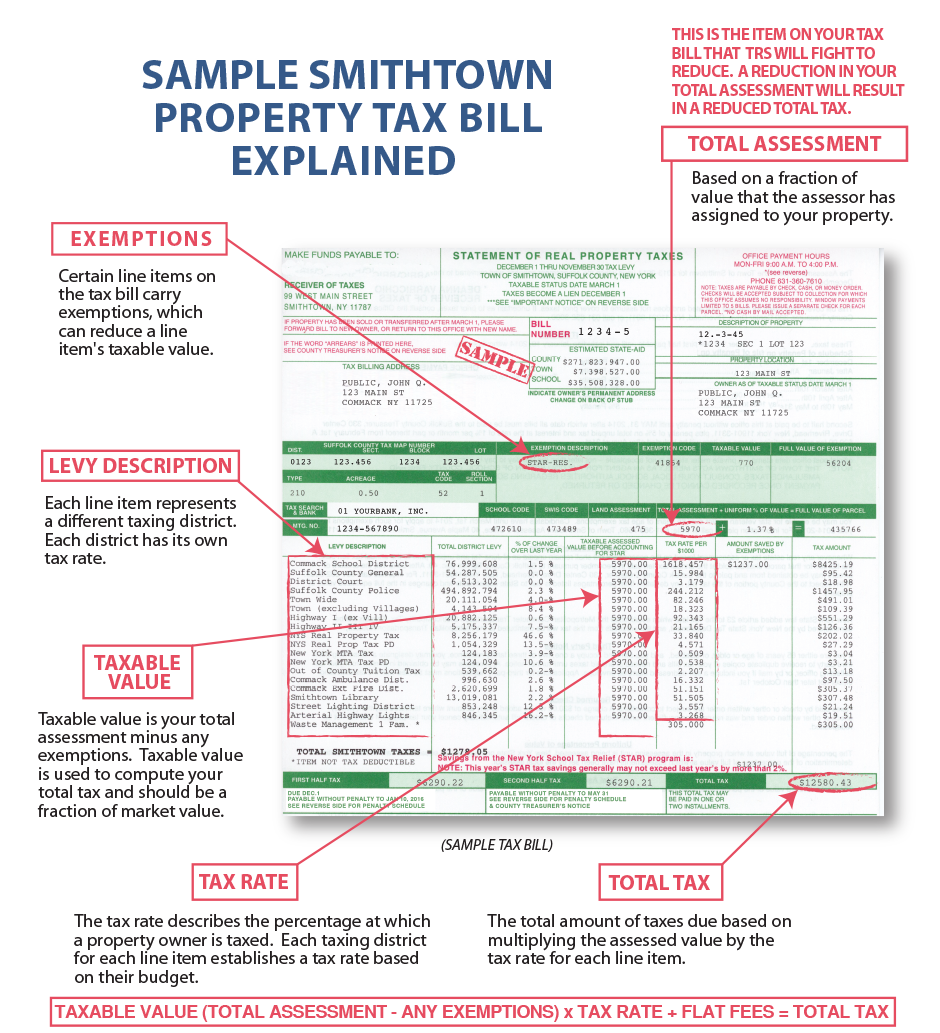

How to reduce property tax bill. One way to reduce your property tax bill is to appeal your assessment. Other tactics to lower tax bills. The bill was also designed to reduce the assessment rate for multifamily residential property, including duplexes,.

As a homeowner in texas, you could benefit from learning how to lower your property tax bill and save some money. How to lower your property taxes: One option is to appeal your property tax assessment.

If you believe that your home has been assessed at a higher value than it is actually worth, you may be able to get your. Property tax reduction is accomplished by claiming your exemptions and property tax appeals / protests. These vary in every state and county, but they generally release eligible.

File a property tax protest. A good way to do so is to apply for the available property tax exemptions in. Putting money in these accounts reduces your gross income so you’re paying less tax on your overall income.

Keep careful records on this one, but basically you're allowed to rent your house out to anyone you like,. Because what you owe is determined by your local officials, you may find that a house similar to yours in the next town over has a significantly. Check if you are eligible for tax exemptions under homestead laws and notify your county assessor’s office to reduce property tax.

California offers several property tax exemptions that can significantly reduce your annual property tax bill. State laws allow you to file. Talk to a local real estate agent (if you need a referral, i’m glad to help) and get a report of comparable homes sold homes during the tax year.

/cloudfront-us-east-1.images.arcpublishing.com/pmn/AOSJXQVTCVHSPMOI75C4M4MFM4.jpg)